Flexicap Mutal Funds , SIP And Lumsum for long term wealth creation

Flexicap funds are diversified equity mutual fund schemes which can invest across market cap segments. There are no upper or lower limits with respect to allocations to any market cap segment. The fund managers of these schemes can invest any percentage of their assets in any market cap segment viz. large cap, midcap and small cap according to their market outlook.

Difference between Flexicap and Multicap Funds

Sometimes investors get confused between flexicap and multicap funds because there are certain similarities between the two categories. But there is an important difference which you should remember. Multicap funds must invest minimum 25% each in large cap, midcap and small cap stocks. In other words, at any point, multicap funds will have minimum 50% allocation to midcap and small caps. Flexicap funds, on the other hand, have no market cap restrictions. They have the flexibility to allocate any percentage of their portfolio to any market cap segment.

You may like to read what is the difference between multi cap and flexi cap mutual funds?

Why invest in Flexicap Funds?

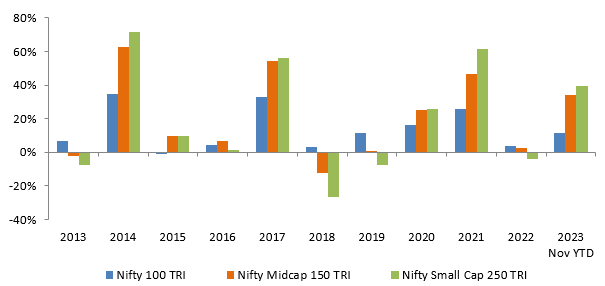

- Winners rotate across market cap segments: One market cap segment cannot keep outperforming or underperforming for a long time. Historical data shows that winners rotate across different market cap segments – see the chart below. Flexicap fund managers can create alphas by prudently rotating allocations to different market cap segments based on their outlook.

Source: NSE, (as on 30th November 2023). Large Cap: Nifty 100 TRI, Midcap: Nifty Midcap 150 TRI, Small Cap: Nifty Small Cap 250 TRI. Disclaimer: Past performance may or may not be sustained in the future.

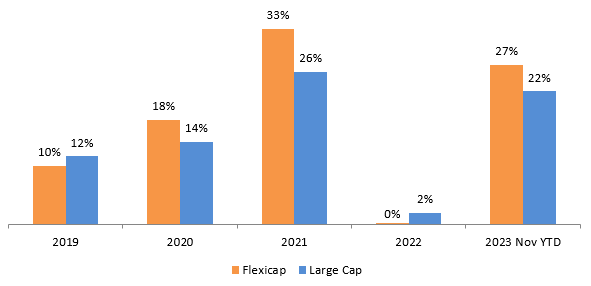

- Greater scope of alpha creation in mid / small caps compared to large cap funds: The chart below shows the annual category average returns of Large Cap and Flexicap Funds over the last 5 years. Large cap funds invest at least 80% of their assets in large cap stocks. Large cap stocks have high percentage of institutional ownership, are more researched and therefore have better price discovery. Hence scope of alpha creation is less in large cap compared to midcaps and small caps, which are less researched. Fund managers may be able to find quality mid and small cap stocks at attractive valuations, thereby creating alphas for investors over long investment horizons.

Source: (as on 30th November 2023). Disclaimer: Past performance may or may not be sustained in the future.

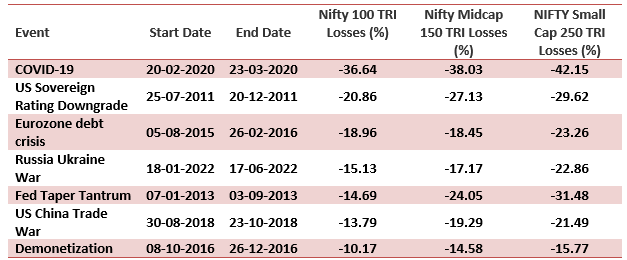

- Less volatile than mid and small caps: The below shows the biggest drawdowns of the last decade. You can see that large caps experienced smaller drawdowns compared to midcaps and small caps. While mid and small caps tend to outperform large caps in bull markets, they tend to much more volatile than large caps. Flexicap Fund managers have the flexibility to quickly shed risks in volatile markets and reduce volatility for investors.

Source: National Stock Exchange, (as on 30th November 2023). Disclaimer: Past performance may or may not be sustained in the future.

- Ideal for retail investors: Prudent financial planning calls for diversification across all asset categories. While more experienced or informed investors can decide how much exposures they want to large caps, midcaps and small caps in their investment portfolios, Flexicap Funds are ideal for investors who are not able to decide how much allocations they should have towards each market cap segments and want the fund managers to decide on market cap allocations. A large majority of retail investors may fall in the second category. Flexicap Fund managers aim for long term capital appreciation while trying to limit downside risks in the short term.

Why Flexicap makes sense in the current market landscape?

As mentioned before, market sentiments are bullish currently. With Lok Sabha elections scheduled in the summer of 2024, a pre-poll rally also cannot be ruled out. Historical data suggests that, in bull market phases valuations of midcap and small cap stocks tend to get overheated (midcap and small cap indices have gone by 42% and 46% this year) unless supported by earnings. On the other hand, there is potential for further upside if earnings growth outlook improves further. In the current market landscape a flexicap strategy, where the fund manager has the flexibility to investment across market cap segments as per market outlook may be suitable for long term investors.

Who should invest in Flexicap Funds?

- Investors who want capital appreciation over long investment horizon.

- Investors with high to very high-risk appetites.

- Investors who have at least 5 years plus investment tenures.

- They are suitable for investors who want to invest from their monthly savings through SIP for their long-term financial goals like children’s higher education, marriage, retirement planning, wealth creation etc.

- You can also invest in lump sum if you ready to remain invested for the long term.

You should consult with your financial advisor or mutual fund distributor, if Flexicap Funds are suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

No comments:

Post a Comment